Trump Media Pushes Bitcoin ETF as Corporate Crypto Holdings Near $85B Amid Market Surge

The cryptocurrency market continues to evolve rapidly, with institutional and corporate interest reaching new heights. Recent filings reveal that Trump Media & Technology Group (TMTG) is seeking regulatory approval for a Bitcoin ETF, while corporate Bitcoin holdings have surged to nearly $85 billion, more than doubling in just one year.

This article explores the latest developments, including Trump Media’s push into crypto, the growing corporate adoption of Bitcoin, and key market movements shaping the industry.

Trump Media Files for Spot Bitcoin ETF Approval

On June 10, 2024, Trump Media & Technology Group (TMTG) filed an S-1 registration form with the U.S. Securities and Exchange Commission (SEC) to launch the Truth Social Bitcoin ETF. This move places TMTG among a growing list of firms competing in the Bitcoin ETF space, which has seen significant inflows since the SEC approved several spot Bitcoin ETFs earlier this year.

The proposed ETF is branded under Truth Social, the social media platform founded by former President Donald Trump. While details remain limited, the filing signals Trump Media’s ambition to expand into cryptocurrency-based financial products.

Critics argue that Trump’s crypto agenda primarily benefits wealthy investors rather than everyday users, as highlighted in recent reports suggesting his policies favor political elites and institutional players.

Corporate Bitcoin Holdings Approach $85B as Adoption Soars

According to recent data, public companies now hold nearly $85 billion worth of Bitcoin, more than double the amount recorded a year ago. The number of firms holding Bitcoin in their treasuries has risen to 116, with many increasing their exposure following the U.S. presidential election.

This surge reflects growing confidence in Bitcoin as a long-term store of value and hedge against inflation. Major corporations like MicroStrategy, Tesla, and Block (formerly Square) continue to lead the charge, but smaller firms are also joining the trend.

The election of Donald Trump has been cited as a contributing factor, with his administration signaling a more favorable stance toward cryptocurrency regulation compared to previous leadership.

Galaxy Digital and Fireblocks Join Botanix’s Bitcoin Layer-2 Network

In another sign of institutional involvement in crypto infrastructure, Galaxy Digital and Fireblocks have announced plans to operate nodes on Botanix, a Bitcoin Layer-2 network. They will be joined by:

- Alchemy (blockchain developer)

- Antpool (Bitcoin mining pool)

- UTXO Management (hedge fund)

This federation aims to enhance scalability and functionality for Bitcoin-based decentralized applications (dApps), further bridging the gap between traditional finance and blockchain technology.

Market Movements: ENA Drops 8%, NEAR Gains 5%, ATOM Rebounds

Ethena (ENA) Sees 8% Drop Amid Whale Activity

A wallet linked to the Ethena project moved a significant amount of ENA tokens to exchanges, triggering an 8% price drop. The transaction coincided with ENA’s listing on Coinbase, raising questions about potential sell pressure from early investors.

NEAR Protocol Surges 5% After Forming Bullish Support

NEAR has shown resilience after bouncing from a key support level at $2.42, climbing by approximately 5%. Analysts attribute the recovery to strong buying interest at lower price levels.

Cosmos (ATOM) Rebounds from 5% Decline

ATOM recovered after a brief dip, with buyers defending a critical support zone. A spike in trading volume suggests renewed accumulation from long-term holders.

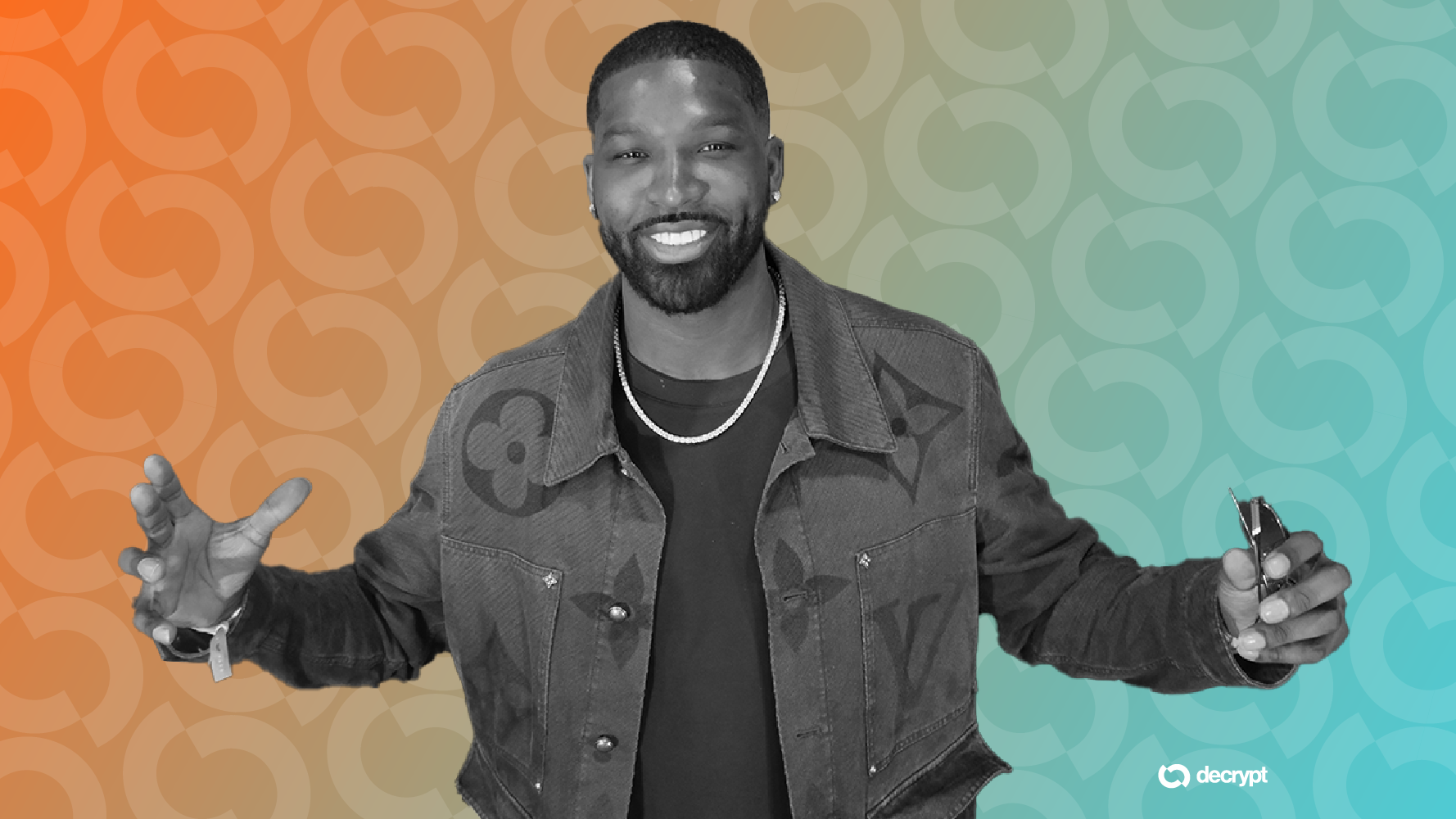

NBA Star Tristan Thompson Compares Bitcoin to Michael Jordan

At Bitcoin 2025, NBA champion Tristan Thompson likened Bitcoin to basketball legend Michael Jordan when discussing top cryptocurrencies:

- Ethereum = LeBron James

- Solana = Kobe Bryant

- XRP = Allen Iverson

His comments highlight how mainstream figures are increasingly engaging with digital assets, further legitimizing crypto in popular culture.

Subs vs. SUBBD: Battle for Creator Ownership in Web3

While Tim Stokely’s new platform, Subs, promises creator ownership, rival project SUBBD claims it already delivers these features to over 2,000 users:

- On-chain creator ecosystem

- AI workflow tools

- Flat 20% fees

- Direct audience control

SUBBD has raised over $600K in its presale and positions itself as an established alternative in the Web3 content monetization space.

Conclusion: A Shifting Crypto Landscape Under Trump’s Influence?

The cryptocurrency market is experiencing unprecedented institutional adoption, with corporate holdings nearing $85 billion and major players like Trump Media entering the ETF race. Meanwhile, Layer-2 solutions like Botanix are gaining traction among financial heavyweights such as Galaxy Digital and Fireblocks.

As market dynamics shift—with coins like NEAR and ATOM showing resilience—the intersection of politics, finance, and blockchain technology continues to evolve rapidly under the influence of key figures like Donald Trump. Whether these developments will democratize crypto or consolidate power among elites remains a contentious debate—one that will shape the industry’s future trajectory.

Images in the article: